Now is the Best Time to Invest in UK Property

With the UK receiving largely negative media attention over the past few years, it is difficult to see the promise of any asset affiliated with the UK and the generally poor outlook for the economy. However, we would argue that now could well be the best time to invest in UK property.

Whether you are a UK national or an overseas investor, there are now some real benefits to investing in UK property.

Housing is needed

The Government have stated that 300,000 new homes will need to be constructed every year to meet current demand and help to mitigate the growing concerns of a housing crisis. Currently, the UK needs to increase house delivery by 25% to meet this target.

The new UK prime minister, Boris Johnson, has made no secret of his desire to increase this with a proposed reform to stamp duty. Although contested by the UK chancellor, the proposed changes would help aid first time buyers in the market, freeing up fees that have escalated in recent years.

So, with demand on the side of new property and the Government’s need to increase housing output, the need for housing is real. But, why should investors jump on this investment asset?

The weakness of Sterling

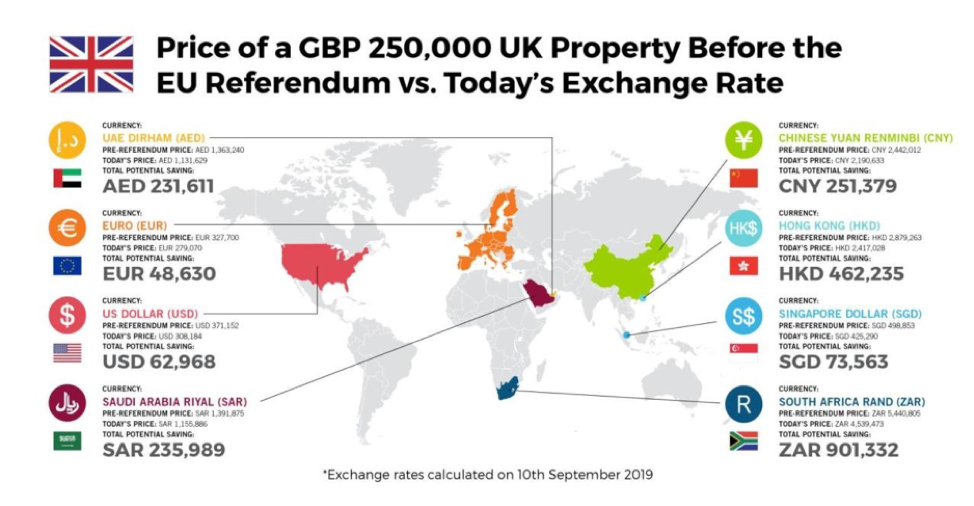

The fall in the value of Sterling has been a significant push for property investors. For perspective, when comparing the fall in value against the dollar, the lure to invest now in UK property are clear.

On June 22nd, 2016, a day before the EU referendum, London property would have set you back roughly $735,294 on average. Fast forward to today, the average cost is roughly $621,300 at the time of writing. A significant $113,994 difference in currency exchange movements alone highlights just how much the value of Sterling has diminished.

On June 22nd, 2016, a day before the EU referendum, London property would have set you back roughly $735,294 on average. Fast forward to today, the average cost is roughly $621,300 at the time of writing. A significant $113,994 difference in currency exchange movements alone highlights just how much the value of Sterling has diminished.

As highlighted from the image, currencies from all over the world have benefited from the fall in value of Sterling. The benefits to those investing from overseas, earning in other currencies, is pretty obvious then – the money you invest in UK property will go far further than it would have just a few years prior.

But how does this benefit UK citizens earning in the local currency? Although the appeal is of course less than overseas investors, you are not losing any value investing with the same currency as you would investing overseas, and the assets themselves are highly likely to see a rise in value over the coming years.

Of course, this will depend on in you have done extensive research and due diligence into the property you are looking to purchase.

The forecast for Sterling

With an outcome to the Brexit saga coming to an end in the near future (we hope!), the certainty of the UK’s position is forecasted to improve the value of Sterling, whether we end up securing a deal with Europe or not.

With a large trade deal on the cards with the US as one example, if and when we leave the EU, we forecast Sterling to surge in value when the result is confirmed, and the dust has settled over the result.

Others are investing in UK property

Despite the fall in foreign direct investment from Hong Kong as a result of conflict within the country, which in recent times have been the UK’s greatest source of investment from overseas, investors from all over the world and the UK alike are investing. Many are simply stating that assets are currently too cheap to ignore.

We truly believe that now is the best time to invest in UK property assets. Property in the UK has seen relatively stable returns, even as a result of the instability of the current political situation. Combined with low variable rates, loan-to-values are up 75 percent making investment now more accessible than ever.

ARE YOU READY TO START INVESTING?

Subscribe to our mailing list now for exclusive deals, investment guides and

the latest information from the property market.

ARE YOU READY TO START INVESTING?

Subscribe to our mailing list now for exclusive deals, investment guides and the latest information from the property market.