UK Property Investment in 2019 | Ultimate Guide

Our next property investment guide delves into a UK property investment in 2019.

The UK property market was slow in 2018. With the effect of Brexit having a negative effect on the market, many will shy away from investing altogether in UK assets amid fear that a UK property investment will continue to fall in value.

Data from the Royal Institute of Charted Surveyors (RICS) draws attention to this, with less property for sale, deals taking a record amount of time to complete, and property staying on the market for substantially longer than in previous years.

Mixed growth for UK property investments across the UK

So, what is the outlook for 2019? Unfortunately, there looks to be a similar trend going forward, particularly in the first half of the year. The market will inevitably continue – unfortunate scenarios in debt and death results in property naturally entering the market. With a continued rise in students going to university and increasing numbers of people moving for employment, there will always be some demand for property. However, buyers will find they have less options in the market.

With tighter lending criteria on mortgages, the purchase of property continues to be an uphill struggle for most. More homeowners are now looking at renovating and extending their existing homes than looking elsewhere. For this reason, the property market is likely to continue ‘treading water’.

It wasn’t all bad news however. We saw economic growth in cities such as Manchester and Liverpool, with a general trend emerging of high growth in the North. London house prices however saw a fall in value.

Mr Burrell, of Capital Economics, says that “prices in London could drop by 5% next year, but rise elsewhere. At a hyper-local level, the performance of a school or the prevalence of crime can affect prices.”

Brexit is cited to be a major reason for this fall in value. RICS were unanimous in blaming Brexit and say that “uncertainty created by the Brexit process is causing buyers and sellers to sit tight in increasing numbers.”

House prices will fall by as much as 30% from a pre-Brexit level if we are to see a “disorderly Brexit”, and house prices could fall by as much as 14% this year alone, according to forecasts by the bank of England. The effects of the dreaded B-word are abundantly clear. It is highly unlikely that we will see a recovery post Brexit either, with those holding property assets abroad also facing uncertainty.

Who is buying property?

Young people that are aiming to get on the property ladder will also have a hard time of this. As mentioned previously, there are stricter lending criteria when it comes to taking out a mortgage, and when combined with higher turnover and a lack of security in employment, saving for a house is ultimately out of reach for most, especially those in big cities with higher property prices.

This speaks volumes when first time buyers were actually the most active on the market in 2018. 1 in 10 buyers received support from Governments help to buy schemes, increasing this demographics likelihood to buy. However, Property Reporter’s recent forecast found that over 50% of those between the ages of 18 – 40 are due to be renting privately owned property by 2025, with one third of those predicted to never buy a home. Could this be an opportunity for property buyers to target this increasing demographic?

The rise of rental income

It is predicted that capital growth will account for just 30% of total returns across UK property to 2023. This forecast is a whole 10% lower than at the start of 2018 and is also noticeably down on the average 55% share we have seen over the past 10 years. Income returns are also predicted to rise to 70% of total returns. This highlights the importance on rental returns over the appreciating value of a property.

You have to consider the unpredictability of the current political situation. The UK housing market is particularly difficult to anticipate, nobody is able to accurately predict how the coming year will unfold. Something is for certain though – Sterling has had an effect on property buying.

The effect of Sterling

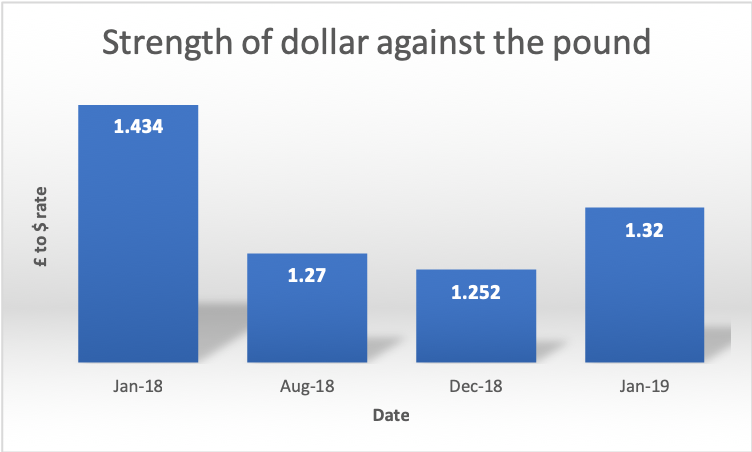

At the start of 2018, Sterling was holding relatively strong against the US dollar. Although not at the same level we have seen over the past decade, a peak of £1=US$1.434 was enough to be favourable for those holding Sterling.

Unfortunately, this was effectively reversed from April 2018 to August 2018. The value of Sterling fell rapidly, with £1=US$1.27. Fast-forward to December 2018, following delays from the EU withdrawal from Europe, Sterling fell even further to a low of £1=US$1.252. As of today, the Sterling is seeing something of a mini-resurgence after the Brexit deal was recently voted down, standing at £1=US$1.32.

For those holding foreign currencies, such as euros or dollars, a UK property investment has naturally been more attractive. Many international buyers will have seen an opportunity to buy up property assets at a reduced price, in the hopes that these assets regain value once the dust has settled. Those holding US dollars will have seen the greatest benefit, particularly in dollar international investment trusts.

Should I invest in UK property?

Those that are holding Sterling will effectively have nothing to lose if they are investing in UK property. It is incredibly difficult to forecast the relative value of Sterling going forward.

We appreciate that the situation may become clear in a few months times, as the result of Brexit becomes apparent. But, there really is no guarantee the economy will be better off afterwards – in all likelihood it will probably be worse.

Attempting to time the market and the political situation is a major pitfall that many investors fall into. Even if you anticipate the result, the market often reacts differently. Stick with what you can control and monitor what you cannot. A long-term strategy for investing will likely see you make a return, even if this is passive.

Where should your UK property investment be?

As discussed, it is difficult to forecast how the coming year will be for the property market as a whole, but we can say with reasonable confidence that a number of areas in the UK will see economic growth.

When identifying where to invest in UK property, we use 2018 as a guideline. London is the area that was most hit by the uncertainty in the market – more specifically, those holding high value properties. With house prices in the capital being the highest in the country, these properties had the most to lose. You could argue that as the political situation settles, London could have the most to gain – something to consider.

When looking at the UK as a whole, particularly those areas in the north, average house prices actually rose. Overseas property buyers saw value in the fall of Sterling, and most targeted areas in the North due to the ongoing effects of what we call ‘Northshoring’.

Northshoring is the result of companies moving to the North to cut operational costs and improve business. The result of this is increased inward migration, and talent coming in from overseas as a result of increased job opportunities. With a lower cost of living than in the capital, the economy in cities such as Manchester are taking advantage of this increase in demand and are growing accordingly. With the aid of data collected by Savills, below are some of the areas that we forecast to receive high growth.

Northampton

Northampton is seeing one of the highest levels of growth across the UK. In 2018, we saw house prices increase by a figure of 5.3%, this being noticeably higher than the national average. Houses sold on average in 33 days, suggesting continued high demand to live in the area.

Leicester

Being just under an hour’s drive away from Northampton, Leicester has reported the best year-on-year growth of all the major UK cities, and is lauded as being the best city to invest in 2018 by Hometrack’s. Property prices have increased by over 250% since the turn of the century.

With a prime location, being just an hour away from both London and Birmingham, it has fantastic links to some major cities. With future investment of up to £3bn, Leicester really appeals as a fantastic UK property investment location.

Colchester

The small Essex town of Colchester has been on the receiving end of some surprisingly high growth in recent times. The town has great transport links, schools and leisure facilities that is boosting the price of property in the area.

Findings by House Simple highlight that house prices over the last three years have grown on average £55,000. In terms of capital growth, rental yield and rental price increase, Colchester is one of the most attractive places to invest in 2019.

Leytonstone

Admittedly, we advised earlier against investing in London property. However, it is difficult to ignore the UK capital, and there are areas in London that can make you a return on your UK property investment. The North-East is the place you should be looking at.

Leytonstone is seen as London’s latest up and coming area and is proclaimed by a third of estate agents based in the capital as the best area to invest in London. With access to the central line, and future regeneration due in the coming years, more buyers are eyeing up Leytonstone and the surrounding area.

With lower prices than in the capital, combined with a rise in average house prices of 83% over the past five years according to property experts Savills, there is hope for London property still.

What property type?

It is easy to get into the mindset that the only property investments available to you are residential. Thinking more broadly, there are many opportunities to turn a profit when focusing on alternative property assets. To do this, we need to focus on the importance of supply and demand in the current market.

Urban logistics has, for a second year running, had the highest forecast returns in the property sector. Annual returns are predicted to be as high as 10% until 2024. The sector has attracted significant investment off the back of major rental growth over the past few years, spiking growth in the sector.

With a forecasted undersupply of Grade-A office space in London in the near future, there is expected to be high growth in this sector. With a re-pricing emerging in the retail sector, opportunities are likely to surface over the next 12 months that are worth keeping an eye on.

Demand in the build-to-rent sector will continue to see increased growth over the coming year. Largely due to consistent returns and familiarity in the market, the sector is an attractive one. Delivering competitive returns by operating at a larger scale and with the overwhelming demand for private rentals, the sector is a great investment opportunity.

To summarise

On the face of it, the UK property market would appear to be best avoided, due to political and economic uncertainty surrounding the country. However, by delving deeper into the market, there are opportunities to be had.

Seek value in the market. Identify an investment that is receiving growth and is also in a high-demand area (think the North). Consider also diversifying your property investments, putting all of your metaphorical eggs into one basket is ill-advised. Consider investing in a variety of property types, if this is within your means to do so, as this will spread the risk of losing money on a single investment.

The property market, as stated, will be difficult to forecast for the coming year. Focus on your long-term strategy, and with the advice above, we are confident you will make a return.

Download: UK Property Investment in 2019 | Ultimate Guide

ARE YOU READY TO START INVESTING?

Subscribe to our mailing list now for exclusive deals, investment guides and

the latest information from the property market.

ARE YOU READY TO START INVESTING?

Subscribe to our mailing list now for exclusive deals, investment guides and the latest information from the property market.