When will the UK property market reopen?

Whilst it is not entirely clear how the UK property market will reopen when lockdown measures are eased across the country, it is expected the process of buying and selling property will be different to what it was before lockdown.

The measures introduced by the Government have been strict having affected most industries, the property market included. With a ban on moving to a new house still in place (unless necessary to do so into an empty property) and those in the purchase phase being asked to stall on completion, questions are naturally arising about how property will be viewed as lockdown measures are eased.

With the Coronavirus Act 2020 also seeing evictions banned, meaning tenants should not have to move if they are unable to pay their rent, now more than ever landlords are expressing concerns over the continued negative economic impact of the lockdown.

With the Government trying to work out the best course of action to get business moving and the property market back up and running, people’s ability to pay the prices we had seen before the lockdown is questionable.

The property market before the lockdown was in a healthy state. So, when will the market reopen, and what could the Government do when restrictions have been lifted to get activity resuming in the market?

When will the market reopen?

The National Association of Estate Agents expects the housing market to reopen for business, in some way, in roughly three weeks’ time.

It is important to stress that the market will not reopen the same way that it was before the lockdown. We are likely to see several key differences in the way the market will operate.

Virtual viewings

Virtual viewings for prospective property buyers was already seeing a rise in popularity before the lockdown was introduced. It proved particularly useful for overseas buyers, cutting on the necessary travel required in the purchase of property.

However, as people are not allowed to physically go out and view property, many have turned to virtual viewings, and the technology involved has taken off.

Whilst not all virtual viewings are top end in production, agents are using virtual viewings to leverage interest and sales. Production of fully featured, 360 videos that allow you to navigate through the whole house is an obvious attraction to those stuck at home, quickly realising the limitations of their own home through this endurance test.

With Rightmove, one of the largest property platforms indirectly encouraging virtual tours via the video tab, coupled with the map and floor plans, both the accessibility and subsequent competitive advantage agents can get to using virtual tours is a no brainer to anyone in the business.

Although virtual viewings are unlikely to fully replace viewing the physical property, it is likely to become a new norm when whittling down prospective property. As lockdown is eased, we expect to see virtual viewings continue to be prominent in the process through each stage of the escalation process.

Mortgage lenders

Many experts are saying that the market needs to reopen gradually to ensure the market adapts accordingly, with some creativity needed here.

Banks and other mortgage lenders will be key here. Whist lenders will of course be more cautious after lockdown, if the confidence seen at the start of the year can be realised again, strong mortgage offers should be offered again to encourage activity in the market.

The differences are clear from the previous financial crash seen in 2008. This was not down to economic negligence, banks are in a good position to lend money, with current difficulties more logistical than anything caused by furloughing of staff and valuations taking longer.

Lenders need to persevere in offering virtual valuations and a more efficient method of transacting on property now and going forwards. Buying a house is well known to be a time-consuming process, lenders can aid in making the process more seamless post-lockdown.

A stamp duty holiday?

The UK is facing a housing crisis, with a shortage of suitable housing to those that need it. Part of the issue here is that people will be deterred from moving homes with the additional expenses occurred, even if the home they are currently in is not suitable.

Agents are therefore calling on the Government to introduce measures to encourage activity in the housing market, this includes a stamp duty cut or holiday to stimulate activity. This tax is particularly detrimental to those that want to purchase a second home. For many, this is to rent out as additional income. With a record high demand for renting, there should be greater encouragement for buy-to-let landlords whilst also attempting to ensure first time buyers can enter the market.

Other measures

In addition to the above, the introduction of Buyer and Seller Information Packs should help to get completions down from the current average of 14 weeks to about 8 weeks. Although still higher than many countries in Europe, the speed in which a transaction can complete will be good for all parties involved.

Surveyors are a key part of the housing market, and the property industry are aware of this. At the very core of the issue, surveyors need to be operational again to do mortgage valuations, the basis of mortgage offers.

Whilst some valuations can be done remotely, it is not always possible, and lenders will not use desktop valuations on higher loan-to-value lending. Physical evaluations need to be carried out to prime lenders into issuing competitive mortgages.

Experts say that, ensuring your legal paperwork and property information us up-to-date and in order will aid in the process after lockdown. With rumours that surveyors (as well as house viewings) being restricted to just 15 minutes with PPE worn throughout, you, as a home buyer, will want to make it as easy as possible for the surveyor to ensure the process does not run on for longer than absolutely necessary.

Encouraging surveyors back out on the road in some capacity to assess properties, encouraging more virtual viewings and the introduction of financial incentives in a stamp duty holiday should be introduced once lockdown measures are eased to breathe life back into the property market, a bedrock of the UK economy.

Should we widen our search?

Interesting search data is coming out of lockdown, this being a rise in people searching further afield for new property. Specifically, property outside of cities and even the countryside is seeing a spike in searches over the past month or so.

The obvious reason here is that working from home was far more achievable than perhaps many thought possible. Buyers are looking to save money by searching for property outside of cities, widening their search as they reassess post-lockdown options.

The need for outdoor space and the desire to avoid public transport are standout criteria that many are prioritising in their house hunt, a huge increase in when compared to lockdown was introduced. If working from home continues to be a reality for many, people will want this outdoor space.

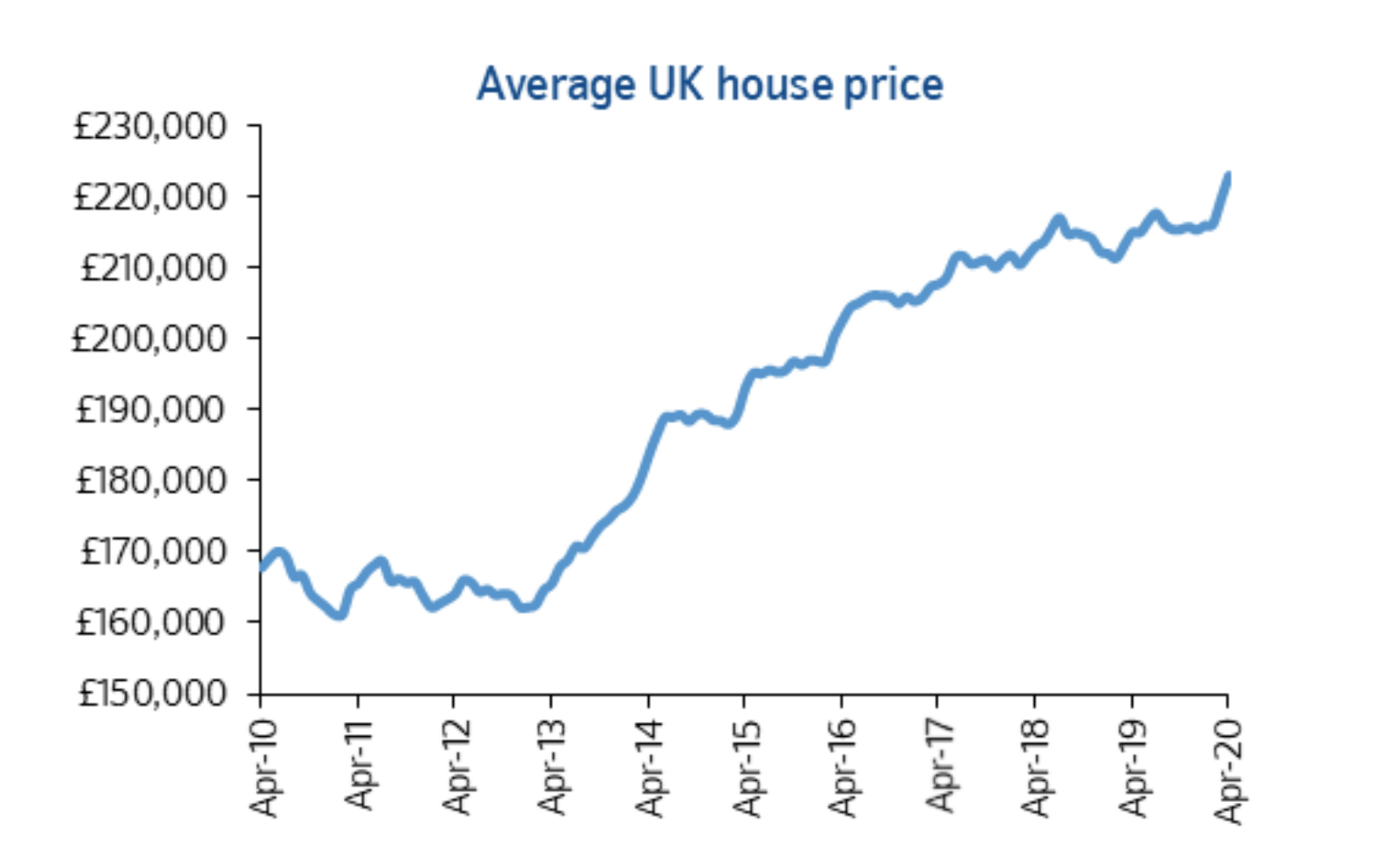

What about house prices?

For those looking to buy or sell property soon, house price fluctuations will play a key part in your appetite to do so.

To many people’s surprise, house prices increased in April, despite the lockdown. Whilst sellers are urged to not get excited about this, much of this rise is based on the pre-lockdown data and is very likely to fall by the end of the month.

Source: Nationwide

The average cost of a property in the country rose by 0.7 percent during April, up by more than £3,000 from this time last year. The market looks uncertain going forwards however and the figures need to be treated with caution.

Lloyds bank, the UKs largest mortgage lender, expects a 5 percent fall in prices this year, with a worst-case scenario prediction of nearly 10 percent. With so many losing an income or taking a pay cut to stay in work, activity in the market will inevitably dip and so too will house prices.

This is of course good news for buyers. Those looking to buy property should be able to secure a good deal as house viewings return, but of course if you are relying on selling your property to purchase the new property, you will get less on this also. First time buyers can benefit here, with even less capital needed to secure a mortgage.

Cautious optimism

Many will be hoping that the market returns to the high levels of activity we saw before the lockdown. Buyers and sellers who were intent to transact before lockdown came into force will likely still be interested in following this through.

Many deals have been ‘paused’ and will resume as we can move home. With the market set to open in some form in the coming weeks, we must hope that activity remains in the market, and the Government can aid this, introducing the changes to the market.

ARE YOU READY TO START INVESTING?

Subscribe to our mailing list now for exclusive deals, investment guides and

the latest information from the property market.

ARE YOU READY TO START INVESTING?

Subscribe to our mailing list now for exclusive deals, investment guides and the latest information from the property market.