Infographic: City Property Investments

Infographic: City Property Investments

From high yielding student accommodation investments to residential buy-to-let developments, FJP Investment has a wide selection of opportunities in city centres in the United Kingdom.

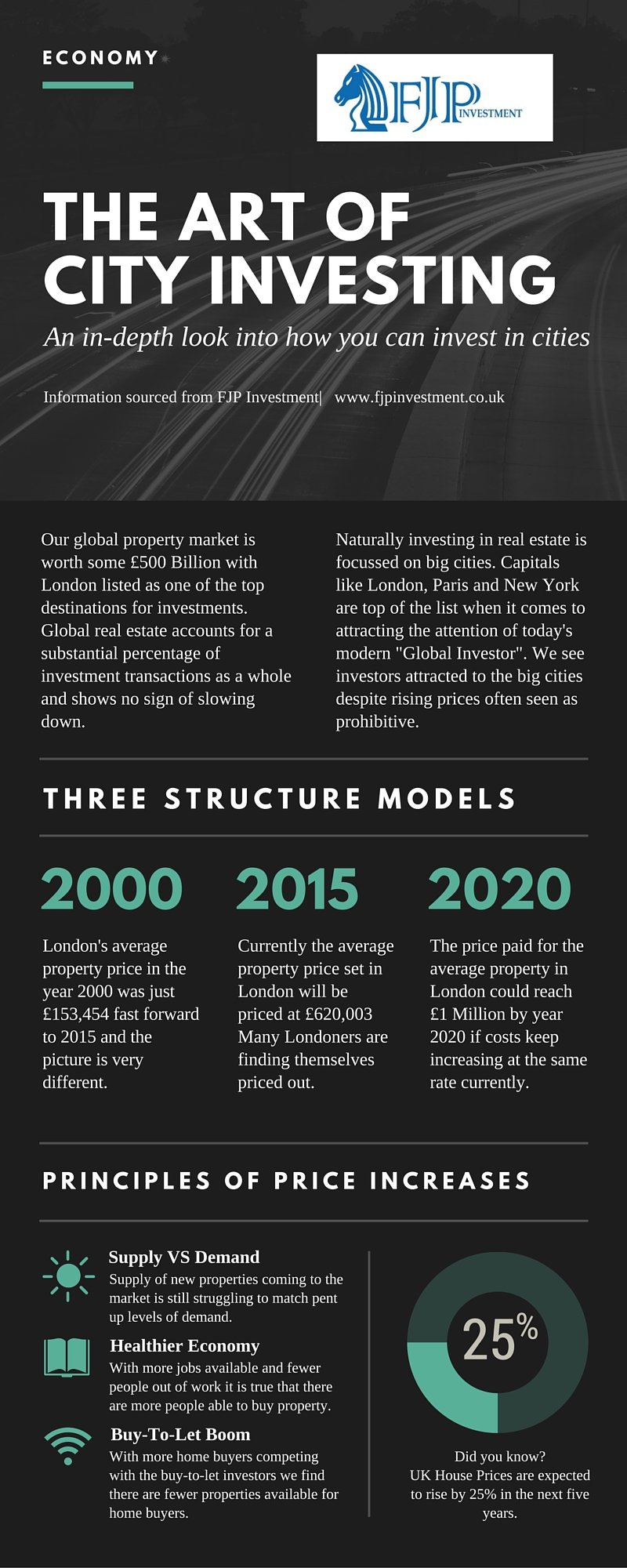

This new infographic has been compiled to help explain why investors should consider making city property investments.

Investing in a city is always a good idea. Ultimately, when buying property for investment purposes, you are going to want to find a human whom is going to want to pay you rent in exchange for living in your property. By virtue of investing in a city, you place your property in front of a higher number of people vs buying in a town or village. Of course, city prices are at a premium, but if you get this right, you’ll be on to a winner.

Best city for property investment

Our global property market is worth some £500 Billion with London listed as one of the top destinations for investments. Global real estate accounts for a substantial percentage of investment transactions as a whole and shows no sign of slowing down.

Naturally investing in real estate is focussed on big cities. Capitals like London, Paris and New York are top of the list when it comes to attracting the attention of today’s modern “Global Investor”. We see investors attracted to the big cities despite rising prices often seen as prohibitive.

Best real estate investments for 2016

To understand future pricing we must analyse historic trends.

- Year 2000: London’s average property price in the year 2000 was just £153,454 fast forward to 2015 and the picture is very different.

- Year 2015: Currently the average property price set in London will be priced at £620,003 Many Londoners are finding themselves priced out.

- Year 2020: The price paid for the average property in London could reach £1 Million by year 2020 if costs keep increasing at the same rate currently.

Principles Of Price Increases

Supply of new properties coming to the market is still struggling to match pent up levels of demand. With more jobs available and fewer people out of work it is true that there are more people able to buy property. With more home buyers competing with the buy-to-let investors we find there are fewer properties available for home buyers.

UK House Prices are expected to rise by 25% in the next five years.

ARE YOU READY TO START INVESTING?

Subscribe to our mailing list now for exclusive deals, investment guides and

the latest information from the property market.

ARE YOU READY TO START INVESTING?

Subscribe to our mailing list now for exclusive deals, investment guides and the latest information from the property market.