Hotel Room Investment | Ultimate Guide [Updated 2021]

Our guide to everything you need to know about a hotel room investment.

Continuing our look into the various ways to invest in property, we now turn our attention to a particularly attractive market – a hotel room investment.

Hotel room investments are appealing for good reason. We are seeing the highest growth in hotel room rates since 2011, travellers are at an all-time high, and we are seeing massive demand from all forms of investors in the hotel property market as a whole, according to Statista. In fact, 2019 defied all odds considering the uncertainty in the market by recording £6bn worth of investment using data released by Knight Frank.

A hotel room investment differs from a standard property investment. We have prepared a simplified explanation for how this form of investment usually operates.

Why invest in a hotel room?

There are many benefits to investing in hotel rooms, the first of which being the accessibility of the investment.

With the ability to easily invest in just a single room within a hotel, the accessibility of hotel investments is a significant factor. When compared to investing in other HMOs (houses of multiple occupancy), the capital required to enter the investment, like student accommodation, is far more achievable for many investors.

Hotel investments are largely considered low risk, too. Some of the largest hotel providers are often seeking investment for further developments. With near-perfect track records, you are almost guaranteed a return.

Most hotel investments offer a return of 125-150% on the acquisition price. As an investor, the contract will often stipulate a buy-back option for the developer at around this percentage. As an investor, you will be looking for a contract that has an optional buy-back, meaning that if the investment is providing you with good returns, you can hold this for a long-term profitable yield.

The investment is also entirely hands-off. Your investment in a hotel room is as simple as making the investment, sitting back, and collecting the income. Although this sounds too good to be true, it often is this easy.

Your investment becomes part of the hotels stock, and this is managed on behalf of the hotel. Depending on the investment type, the hotel either takes a percentage of the income from your hotel room(s), or you take a percentage of the hotel’s overall income.

Given you have researched a safe hotel investment, and you have used a reputable investment broker, there is little reason you will not get a return on your investment. For investment opportunities, we recommend checking out some of our current investment opportunities.

What hotel type?

In 2016, we highlighted that it was safer to invest in luxury hotels. Where this does continue to be the case, lifestyle & boutique hotels go a step further and look set to be the future.

You may be asking what a lifestyle hotel actually is, and this question is shared by many. James Sabatier, CEO of Two Roads Hospitality, says that “Lifestyle, to me, is about experiences. It ́s about feeling a sense of place. It ́s what travellers want more and more…”

Although the definition itself appears to be losing some meaning, with many new hotels claiming to be ́lifestyle ́, the concept is essentially offering beautiful, uniquely designed hotels that also provide an intimate and personal service.

What sets a lifestyle hotel apart from the conventional luxury hotel is the appeal these hotels have to the younger generation. According to STR, millennials spend marginally less annually than older travellers on hotel stays, but they are far more likely to spend money on a lifestyle hotel than a luxury hotel.

Internationally, STR also report the lifestyle sector has an average room rate of $229, with occupancy close to 76% across the board. This room rate is significantly higher than the average of $131 across the hotel sector, and also boasts a 10% greater occupancy rate. Clearly then, lifestyle hotels are where the market is currently at, and something you should target when making a hotel investment.

Demand for hotel room investments

The demand for hotel rooms are on the rise. According to Statista, we are currently seeing a 5% growth on average hotel rates in 2019, this being due to a rise in the economy and increased demand by travellers.

International tourists in the UK are on the rise, up 7% from 2018, and this is set to continue according to UNWTO World Tourism Barometer. The reasons for this being the upsurge in the silver economy, the continued appeal of travel to younger people, and the rise in Chinese tourists as the country continues to grow in wealth. These trends look set to continue, with the reasons for this rise looking unlikely to be temporary factors.

The rise of Airbnb

Naturally, you may be cautious of hotel investments with the rise of Airbnb. A recent report by STR highlights that in areas where the average review scores on Airbnb were above average, hotels charged a marginally lower rate, presumably to supplement these reviews and attract more travellers. This was also applicable to Airbnb rentals that posted below average prices for the area.

The results did show that Airbnb has had almost no impact on RevPAR (revenue per available room) in the hotel market though, with Airbnb accounting for just over a 1% decrease in RevPAR. This supports the leading argument that Airbnb is offering more of a supplementary service to the hotel industry. Airbnb in itself is proven to be very unlikely to have a significantly negative impact on a hotel room investment.

Where to invest in a hotel room investment

Investors eyeing London

A recent study by Cushman & Wakefield reveals that London is now the top city for hotel property investment worldwide. This is thanks to several large deals back in 2017, doubling the transaction volume from the previous year. This highlights London as a strong investment market, and also the fall in American cities receiving lower investment than the previous year.

Head of Investment Strategy at Cushman & Wakefield, David Hutchings, says that “London has battled through political headwinds to charm both hotel investors and consumers. Its rich culture, history and leisure scene, alongside its business operations, is proving to be a solid bedrock for its hospitality sector which continues to go from strength to strength.”

The result of this may come as a surprise to some. London made the leap from seventh the previous year, narrowly edging out New York to top spot.

Investment has fallen in the US by 21% when compared to the previous year. This is cited to be due to new legislation enforced in mainland China and Hong Kong, resulting in a cooling of capital flow. This comes after several years of high investment in the US.

Head of Hospitality at Cushman & Wakefield, Jon Hubbard, says that “We are seeing an increasing diversity amongst the type of investors coming to play, including institutional investors, whose presence in the market is reducing the risk profile and driving a surge in liquidity”.

The result of this means that we are seeing an uptake in major operators considering leases for strategic situations, and the rising interest of institutional buyers to invest with potential for high returns.

Broaden your search

From an investment perspective, it is clear that there is demand in London for hotel property, but there is already supply in place to match it. You could argue that identifying areas of high demand, but low supply could result in greater yields. In addition, an investment in a hotel in London is likely to be higher than it would be elsewhere, so the capital you are willing to invest is something to consider.

You have to think long-term when it comes to investing also, and although London is currently top for hotel property investment, PwC global anticipate that this growth in London will not be sustained.

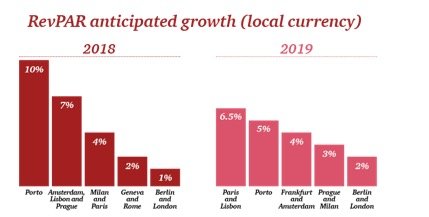

The report shows that investors should be looking at Europe for hotel investment, with Portugal leading the way for anticipated growth. With a 10% increase in RevPAR set to be achieved in Porto in 2018, and 7% in Lisbon, Portugal is seeing major economic growth. When compared to the anticipated 1% in London, the benefits of looking elsewhere are apparent.

Hotels will always have high demand as consumer output is increasing and disposable incomes become more available. Hotels are not just seen from a practicality perspective of simply finding somewhere to sleep. The market is seeking experiences and there is a high paying segment of experience seekers whom pay top dollar for memorable moments.

With the result of Brexit fast approaching, it appears unlikely that London will remain as the top city for international hotel investment. London is, however, tried and tested as a fantastic option for hotel property investment, regardless of the fall in growth.

Seasonality

Something that can be overlooked when making an investment in a hotel is the effects of seasonality. You may be investing in an area that sees high traffic in the summer, but low traffic in the winter, and therefore you need to anticipate this.

Findings by Statista have found that December is the most profitable month for hotels worldwide, consider this when making a hotel investment. Choosing an area that has high demand all year round, although difficult, is not impossible.

Seville is a good example. Lonely Planet rated Seville as the best city to visit in 2018, and sees visitors flocking to the city all year round. The city hits its peak between the beginning of June to the end of September, but also sees high footfall in the month of December. The city is not hit with the impact of the low season when compared to other areas of Spain and is therefore a good investment location.

Take for example, the Costa Del Sol in Spain – seasonally – the Summer months are the money months. From June to September – it is often said that hoteliers make their money in the Summer and are to put money away to survive the winter months when demand is much lower. Though, all being said; the Costa Del Sol does benefit from great weather all year round and the winter months are a different niche of clientele such as those of an older age seeking some winter sun.

Potential drawbacks to a hotel room investment

Something to consider is that it can go wrong. Although this is not a common occurrence, your profits as an investor directly correlate to the success of the hotel itself. The RevPAR of an investment can be affected in many ways, some examples include the economy, terrorism fears in the area and even natural disasters.

These factors can positively affect your investment however. If you are investing in an area that is unlikely to draw any of these inherent problems, you could benefit from more traffic to your hotel investment.

When investing in hotels, you are at the mercy of any change of direction the hotel may choose to go in, even if you are not in agreement. For instance, the hotel may see an opportunity to target the luxury market. If this fails, the failure is shared with you as an investor.

You also have to take into account any management costs that the hotel will deduct from your income, something that is not included with other property investments. Ensure that management costs are explained, and that the contract clearly defines what this includes to avoid paying out large sums from your profits.

You may be investing in a future build. In the event that a developer liquidates, there is a reasonable likelihood that another developer will take on the project, though this cannot be guaranteed. As with any investment, you have to be aware that there is always an element of risk involved, even if this is usually small.

Conclusion

Investing in hotel property is a relatively straightforward and safe investment, with returns often provided over long periods. As with any property investment, it is important that you do some research into the development.

Get a realistic estimate on what the RevPAR is likely to be for the investment, taking into account location and trends in the market. Make yourself aware of the potential pitfalls of investing in a hotel and compare the benefits to other property investments, such as student housing or a different HMO. Ensure the contract you are signing is to your benefit and seek out an optional buy-back.

As with all property investments, a hotel investment could well be the investment for you, just be sure to do your own research.

There is big money to be made from hotel room investments. Ultimately, it will come down to the location, quality of the offering and the pricing. If the formula is correct, the equation will result in a great return on investment from your invested capital.

We always see hotel room investments as an excellent income generation asset. Cash flow is regular but it is very important to get the sums right as at times, the margins can be tight.

Download: Hotel Room Investment Ultimate Guide

ARE YOU READY TO START INVESTING?

Subscribe to our mailing list now for exclusive deals, investment guides and

the latest information from the property market.

ARE YOU READY TO START INVESTING?

Subscribe to our mailing list now for exclusive deals, investment guides and the latest information from the property market.